NEWS

Purchasing power (May 2024)

© Stock.adobe.com

While the prices of consumer products and fossil fuels are stabilizing, it is now the prices of electricity and services – especially insurance and internet subscriptions – that are taking over.

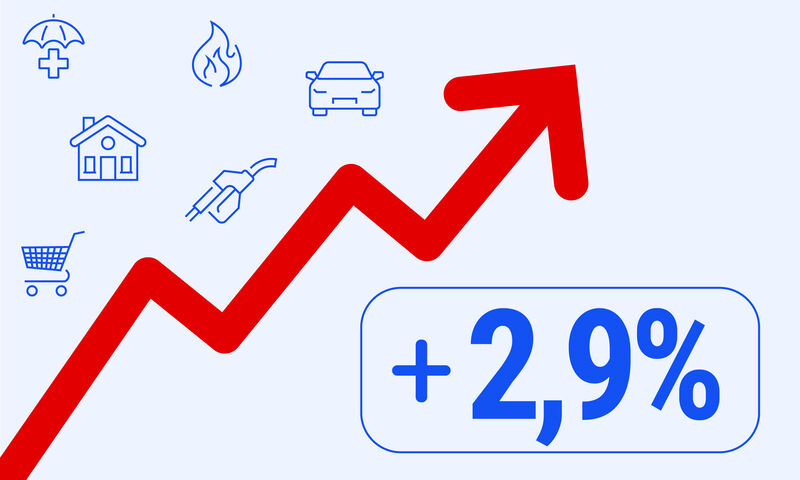

Will the crisis soon be behind us, with a prolonged lull on the inflation front? The latter remains below the 3% mark on the annual average for the second month in a row: prices in May 2024 are 2.9% higher than those in May 2023 (+2.7% in April). However, over the course of 1 month, they rose slightly, 0.2% more than in April. And they are far from pre-crisis levels: they are 14% higher than in January 2022, when labels began their jump.

Calm has returned to supermarket shelves, with food products and drugstore-hygiene-cosmetic items showing small increases in May, up 1% over 1 year and 0.3% over 1 month. Commercial negotiations between distributors and their suppliers at the beginning of the year ultimately did not cause a big jump in prices on supermarket shelves. A slight increase was recorded for certain product categories (sweet foods, dairy products and meat products, drugstore-hygiene-beauty), but on a very modest scale compared to the epidemics of the previous two years.

Beware, however, of the hidden inflation we’ve spotted on several food and hygiene products among supermarket hits: for example Chocapic for children, Friskies for kittens. For these products, the increase in price per kilogram is disguised by packaging changes. Look at the price per kilogram (or per liter) – if you remember it from one race to another!

However, consumers are not done with huge bills. Now it is services and electricity that drive inflation. Next increase in electricity tax in Februarythis item became the most inflationary, higher than last year by 20%.

But insurance and digital subscriptions are not left out. Contributions for health and multi-risk home insurance are increased by 9% (or even more depending on age) and 8% respectively (due to more frequent weather events and higher repair costs). Packages (mobile phones, Internet boxes) collect 4% more. Maybe it’s time to introduce competition and change Complementary healthfromHome insurancefrom Internet box or mobile phone tariff. Our online comparators can help you.

Methodology

What to choose estimates the inflation rate from month to month, based on its own observations. For almost 40% of consumer spending, we have data that allows us to estimate monthly price variations, based on our readings in supermarkets (for food, drinks and hygiene-beauty), as well as on price offers taken from our price comparators ( energy , fuel , mutual , mobile plans , internet service providers , home insurance , banks , Household appliances). Each price is then weighted by the frequency of purchase and added to the overall average.

For other expenditure items (rent, housing and transport costs, hotels and catering, leisure, clothing and health), Que Choisir refers to INSEE estimates.

Please note: by convention, price variations during a period (for example for the month of May 2023) are calculated in relation to the same period of the previous year (the month of May 2022). This is to avoid seasonal price movements (for example, the price of fruits and vegetables, which are highly dependent on the season and harvesting conditions).