When paying online, Google facilitates the verification of card data without the need to enter the security code, which is often tedious to find. Now Chrome and Android users will be able to confirm their card information the same way they unlock their devices: by fingerprint, facial recognition or PIN. This method simplifies online payment, and also protects sensitive information from unauthorized access.

Card details under guard

The search engine also offers an option to unlock the device before viewing the full card details, ensuring that this information is only accessible to authorized users. This new provision strengthens the protection of banking data.

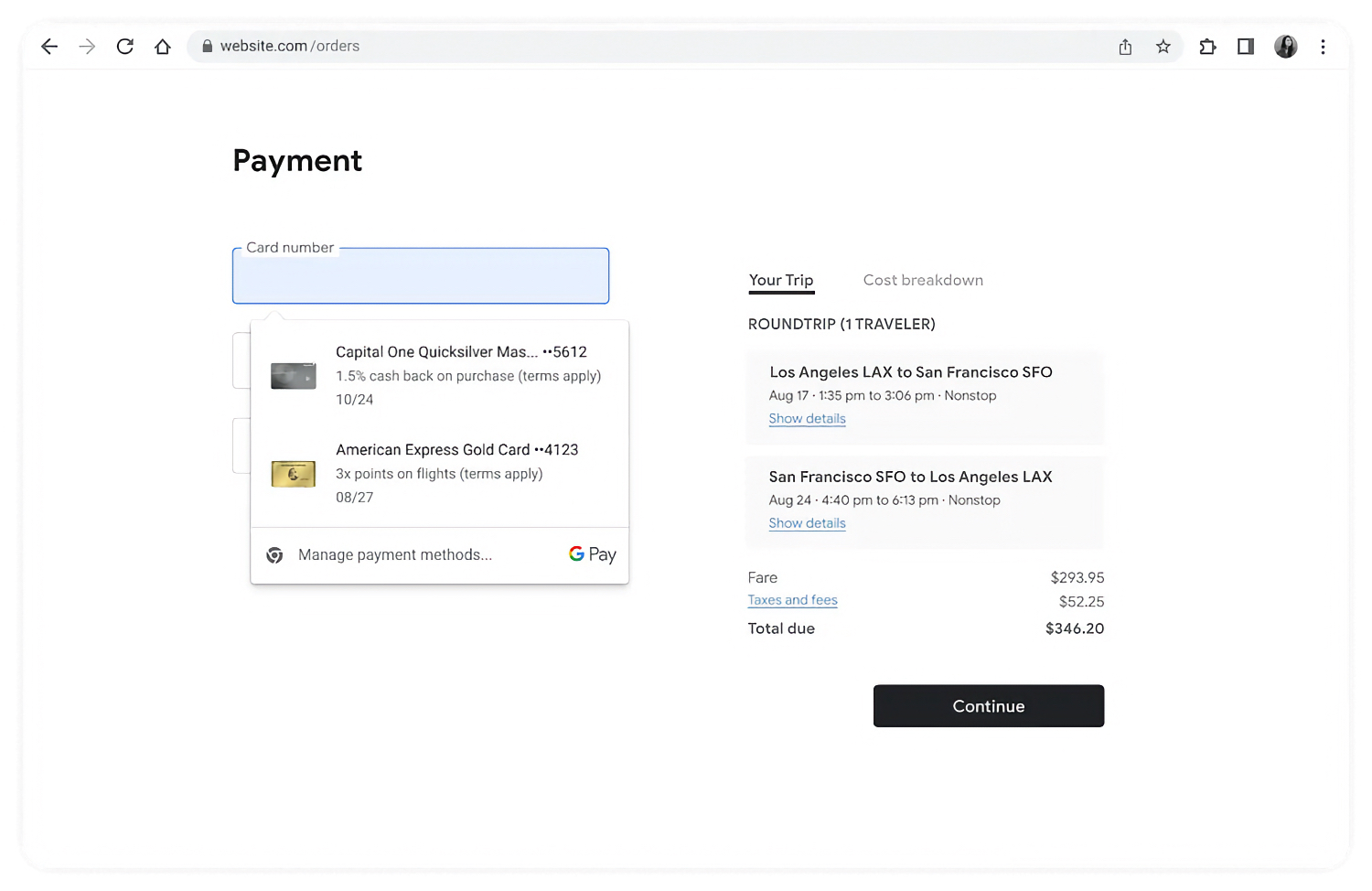

In the United States, Google Pay users will be able to see the benefits and rewards of their cards before making a choice during payment. This feature, initially available to American Express and Capital One customers, makes it easy to select the most beneficial card for their specific needs, whether for travel, dining or cashback.

When selecting a card, a detailed description of the benefits (” 1.5% cashback on purchases “Or” 3x points on flights “), will be displayed. Google plans to expand this feature to other maps in the near future.

This new feature answers a frequent request from users, who often do not remember the advantages of each card. From now on, a simple consultation of the list of cards registered in Google Pay will be enough to choose the best option, making the selection process simpler. For now, this feature is limited to desktop Chrome users, but extensions are in development.

Another important development is the widespread introduction of the “buy now, pay later” (BNPL) option. Already tested at the beginning of the year, this functionality is now available on more business sites and Android applications in the United States. In partnership with companies specialized in credit, Google Pay can divide payments into several installments, giving consumers greater financial flexibility. Although in the end, you will have to pay the entire amount requested, of course.

This certainly attractive option requires rigorous management of the terms to avoid unfortunate consequences, such as recovery actions or a deterioration of the credit rating. Google Pay thus facilitates the purchase to pay, but also encourages the responsible use of this functionality.

🟣 To not miss any news on the Journal du Geek, subscribe to Google News. And if you love us, we will a newsletter every morning.