If the earthquake in Taiwan served as a trigger for price growth, the fundamental trends driving the market remain AI and language model training, as well as the massive production takeoff of HBM memory, which is expected to flood the markets in the second half of 2024.

While the memory market SIP shaken by technological developments and new needs for performance and availability caused by artificial intelligence and model training, external factors have just challenged previous forecasts.

According to figures released by Trendforce, the seasonal increase in DRAM contract prices would follow a predictable course of 3 to 8%. But that was before the March 4 earthquake in Taiwan. The market was in a moderate upward trend, influenced by sustained but slowing demand.

Since then, forecasts have been shot down by earthquakes and fears of a production slowdown. TrendForce estimates that DRAM contract prices for the second quarter are expected to increase by 13-18%, and NAND flash by 15-20%.

In an environment where the market is characterized by trends that support demand and influence prices, the rise of artificial intelligence applications and the increase in data center capacity are strongly driving the demand for DRAM. Inference and model training servers require large memory capacities to process huge amounts of data.

The imminent takeoff of HBM memories

Additionally, a new generation of DDR5 memory is starting to replace DDR4, offering improved performance, increased bandwidth and better energy efficiency. The transition to DDR5 leads to increased demand for these memory modules, although prices remain relatively high during the initial period of their adoption. This is accompanied by a boom in the production of HBM (HightBandwidth Memory) memory.

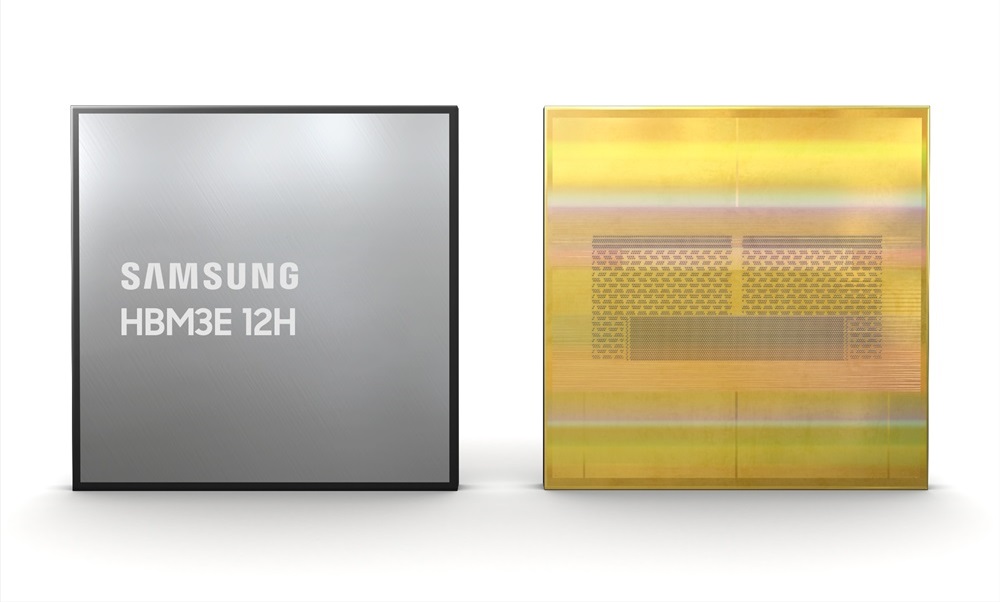

HBM technology is designed to provide high bandwidth compared to traditional memories. One of its characteristics is its vertical stack architecture, where several layers of DRAM chips are stacked on top of each other and interconnected by TSVs (Through-Silicon Vias), passages that pass through the silicon that allow fast and efficient connections between the different layers. HBM is primarily used in infrastructure and high-performance products, such as graphics cards, supercomputers and artificial intelligence servers.

Moreover, TrendForce predicts that demand for HBM technology should cause a shortage of DRAM memory in the second half of 2024. “Memory giants Samsung, SK Hynix and Micron are actively investing in high-bandwidth memory (HBM) production. Industry sources cited in the Commercial Times report indicate that due to the effects of overcapacity, DRAM products could experience shortages in the second half of the year. »

HBM production will be a priority due to its profitability…

According to TrendForce, the three largest DRAM vendors are ramping up their wafer production for advanced processes. As a result of the increase in contract prices for memory, companies have stepped up capital investment, which is expected to translate into capacity expansion in the second half of this year. Wafer production for 1alphanm and wider processes is expected to account for approximately 40% of total DRAM wafer production by the end of the year.

It is clear that HBM production will be a priority due to its profitability and the growing demand for HBM modules. As for the latest developments in HBM, TrendForce reports that HBM3e will become the market standard this year, with shipments concentrated in the second half of the year.

For DRAM, prior to the 4/03 earthquake, TrendForce had originally forecast DRAM contract prices to increase seasonally by 3-8% and NAND Flash by 13-18%, slowing significantly compared to the first quarter.

This was indicated by spot price indicators, which showed a weakening of price dynamics and a decrease in trading volume. This is mainly due to sluggish demand outside of AI applications, particularly laptops and smartphones.

…and reach 60% of production capacity in 2024

In fact, inventory levels have been gradually increasing, especially among PC OEMs. Additionally, with DRAM and NAND Flash prices rising for 2-3 consecutive quarters, customer reluctance to significantly increase prices acted as a barrier.

After the quake, the market was buzzing with sporadic reports of PC OEMs agreeing to significant contract price increases for DRAM and NAND Flash for special reasons, but these transactions were isolated.

At the end of April, after a new round of contract price negotiations was completed, price increases were higher than initially expected. This prompted TrendForce to upwardly revise second-quarter contract price increases for DRAM and NAND Flash, reflecting not only buyers’ desire to support the value of their inventories, but also the supply and demand outlook for the AI market.

TrendForce reports that manufacturers are concerned about the possible effects of increasing production of HBM memory. In particular, Samsung’s HBM 3e products, which use the 1alpha process node, are expected to use approximately 60% of production capacity by the end of 2024.  This significant production shift is expected to constrain DDR5 vendors, especially as HBM3e production ramps up significantly in the third quarter. In response, customers are strategically increasing their inventories in the second quarter to prepare for expected HBM shortages beginning in the third quarter.

This significant production shift is expected to constrain DDR5 vendors, especially as HBM3e production ramps up significantly in the third quarter. In response, customers are strategically increasing their inventories in the second quarter to prepare for expected HBM shortages beginning in the third quarter.